Overview

Credit rating for small and medium-sized enterprises (SMEs) presents a challenge compared to larger, well-analyzed companies. While big data for SMEs is increasingly available, current classical machine learning models are limited in their ability to handle large data sizes and deliver faster ratings. There is a need for a more accurate and efficient credit rating system that can leverage the potential of big data and overcome the limitations of traditional approaches.

Our Innovation

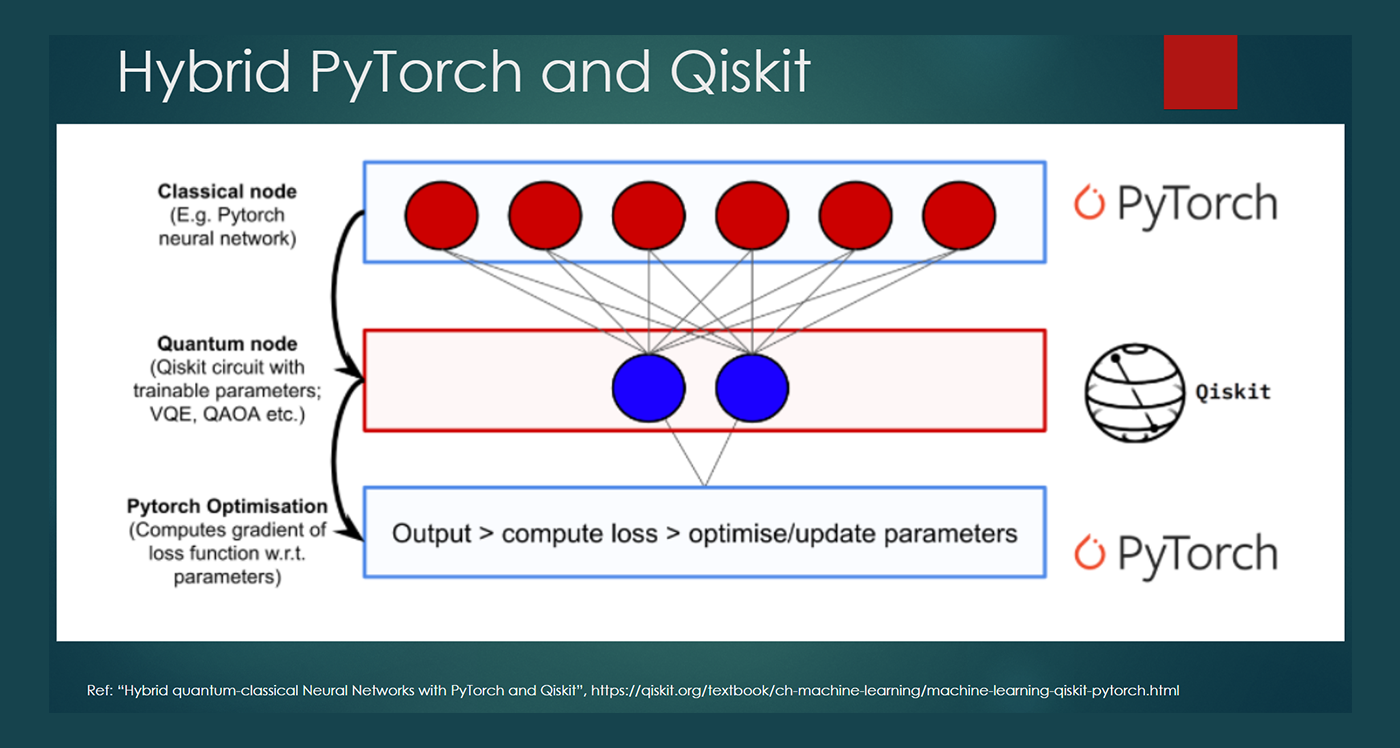

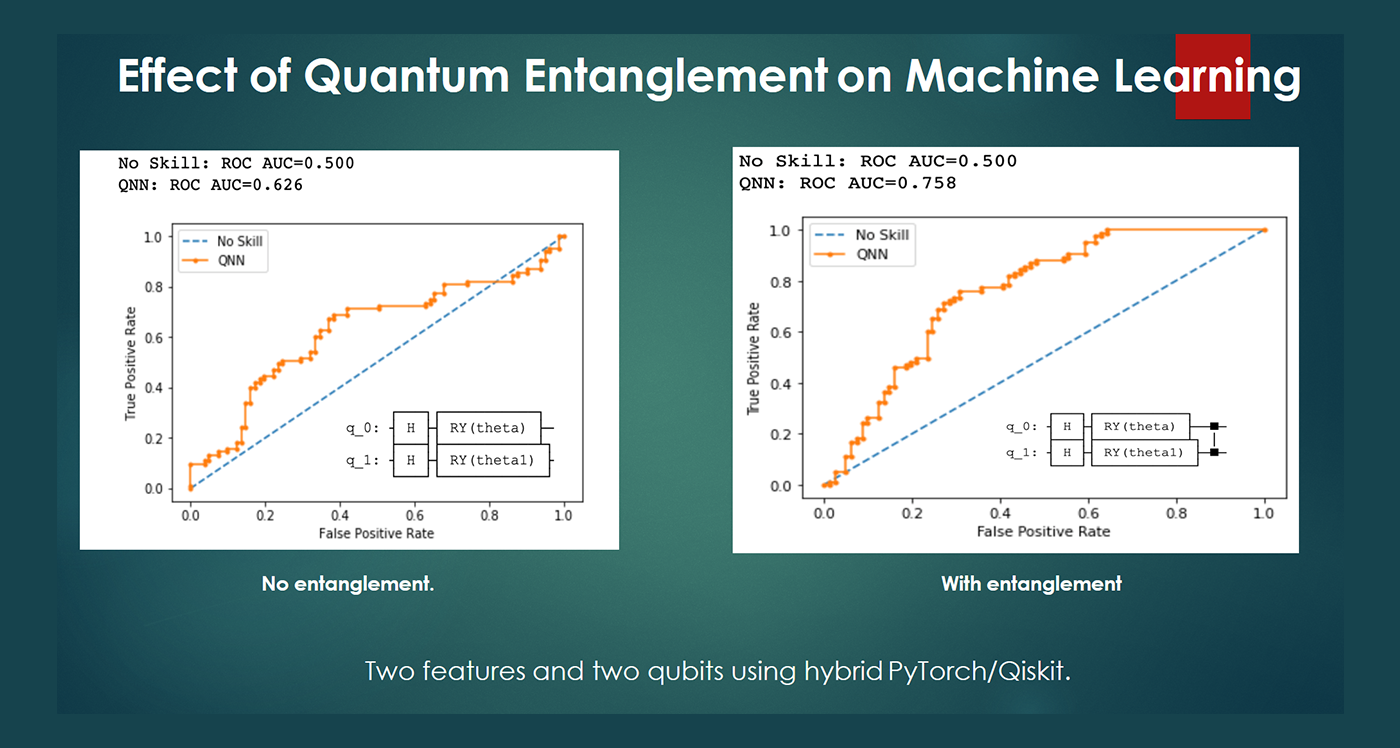

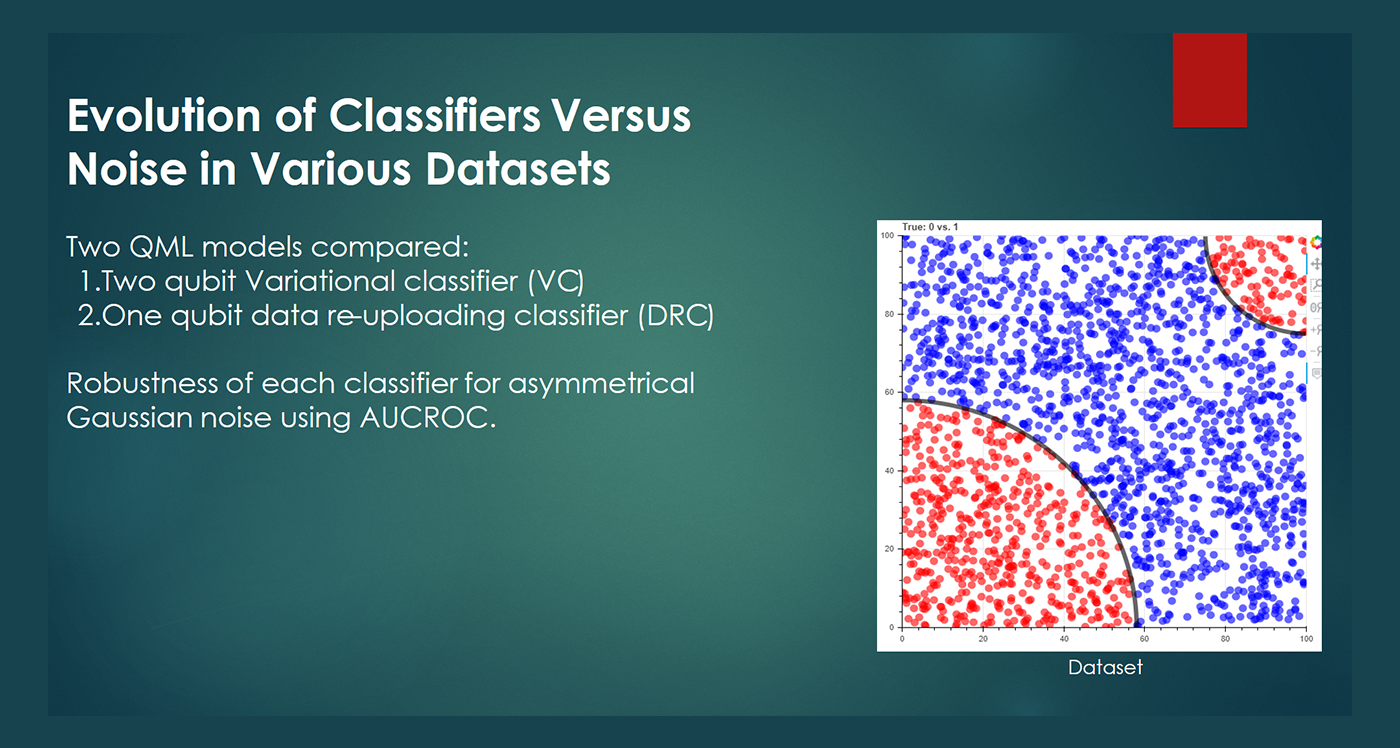

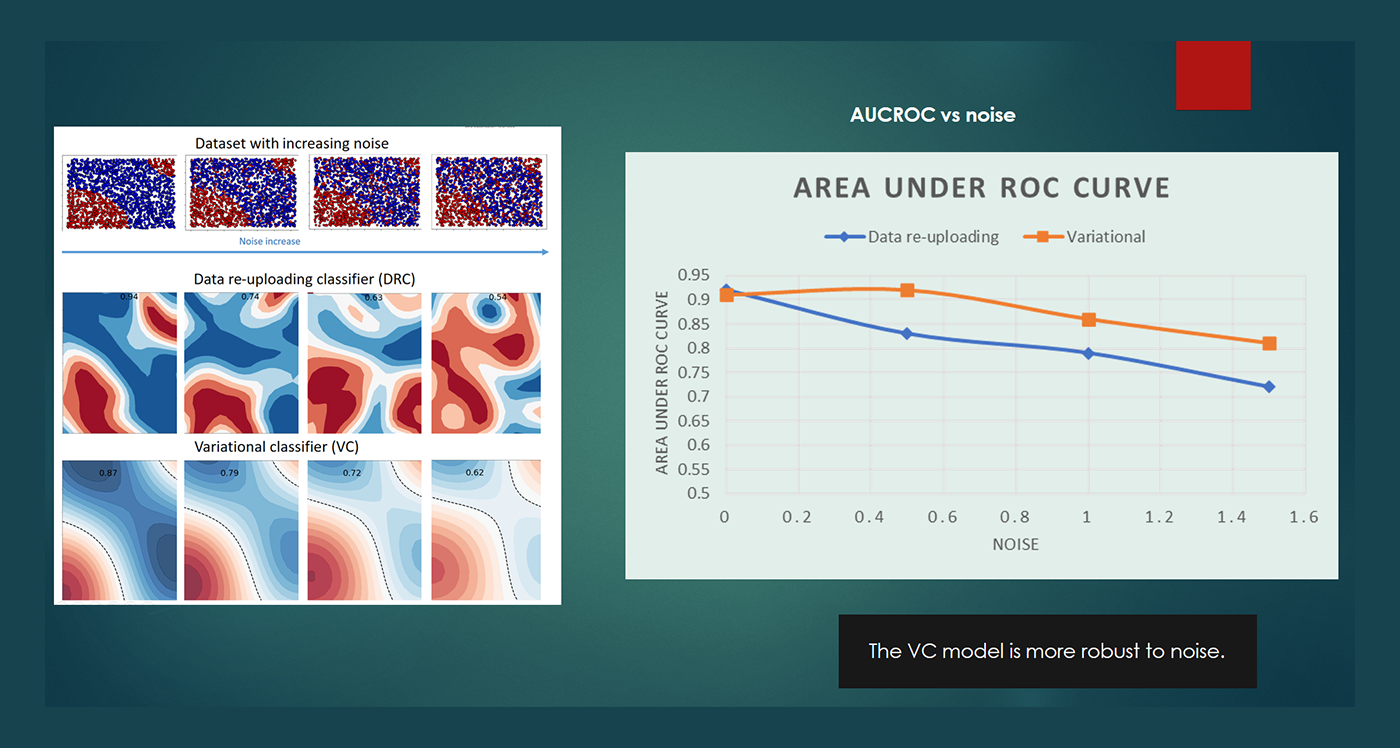

We introduce Quantum Machine Learning (QML) models, which utilize quantum computers for credit data analysis in Singaporean companies. These QML models offer significant advancements over classical machine learning models by harnessing the power of quantum entanglement and leveraging quantum computing capabilities. Unlike classical models, QML models employ qubits and quantum gates, taking advantage of quantum superposition and entanglement. The use of classical-quantum hybrid neural networks provides a quantum advantage and enhances learning metrics. Additionally, QML models demonstrate improved resilience to noise in credit datasets, which are known to be particularly noisy.

Benefits

- QML models provide a boost to learning metrics, resulting in improved credit rating accuracy, and reducing the rejection rate for good SMEs while lowering the risk for lenders.

- Quantum computers enable faster processing of large datasets, allowing for more timely credit ratings and faster decision-making processes.

- QML models demonstrate robustness in handling noisy credit datasets, ensuring reliable and accurate credit rating outcomes.

- Flexibility and representational authenticity for complex optimization, stochastic modelling, and intelligent decision-making in financial services and other industries.

Applications

- Primarily focused on credit rating for SMEs in Singapore, but applicable to any industry using classical machine learning models.

- QML models can be developed for various datasets that benefit from quantum processing capabilities.

- Relevance in financial services for optimizing processes, stochastic modelling, and leveraging AI approaches.

- Improving financial inclusion by accessing fundings for SMEs.

If you're interested in this technology, please contact KTC.