Credit rating for SMEs is always a challenge compared to large companies that are well analysed. Big data for SMEs is increasingly available and can help to improve the accuracy of the liklihood of a company defaulting. Current classical machine learning models have improved accuracy over typical Altman Z-scores but are expected to become limited as data sizes increase and faster ratings are expected.

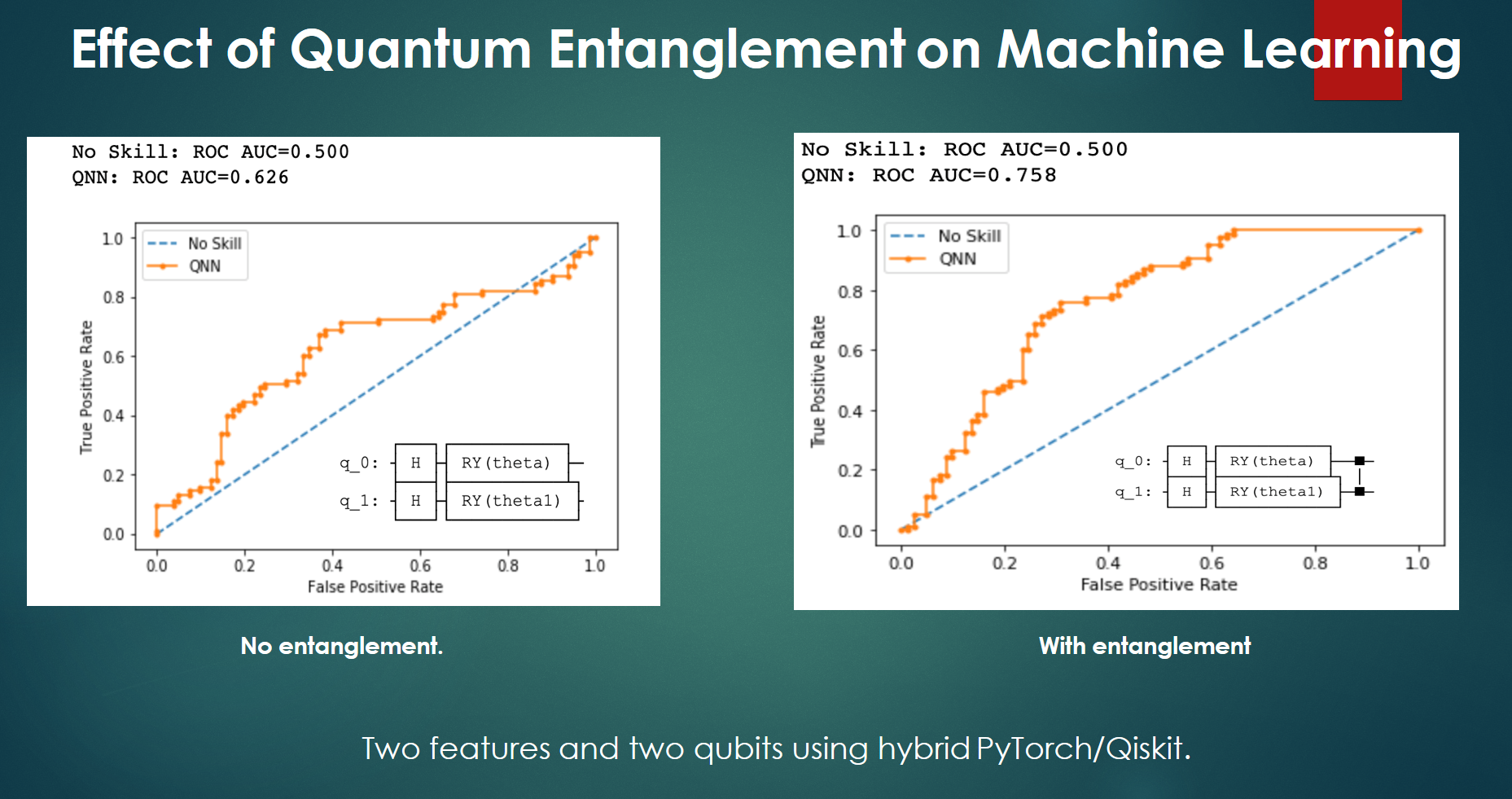

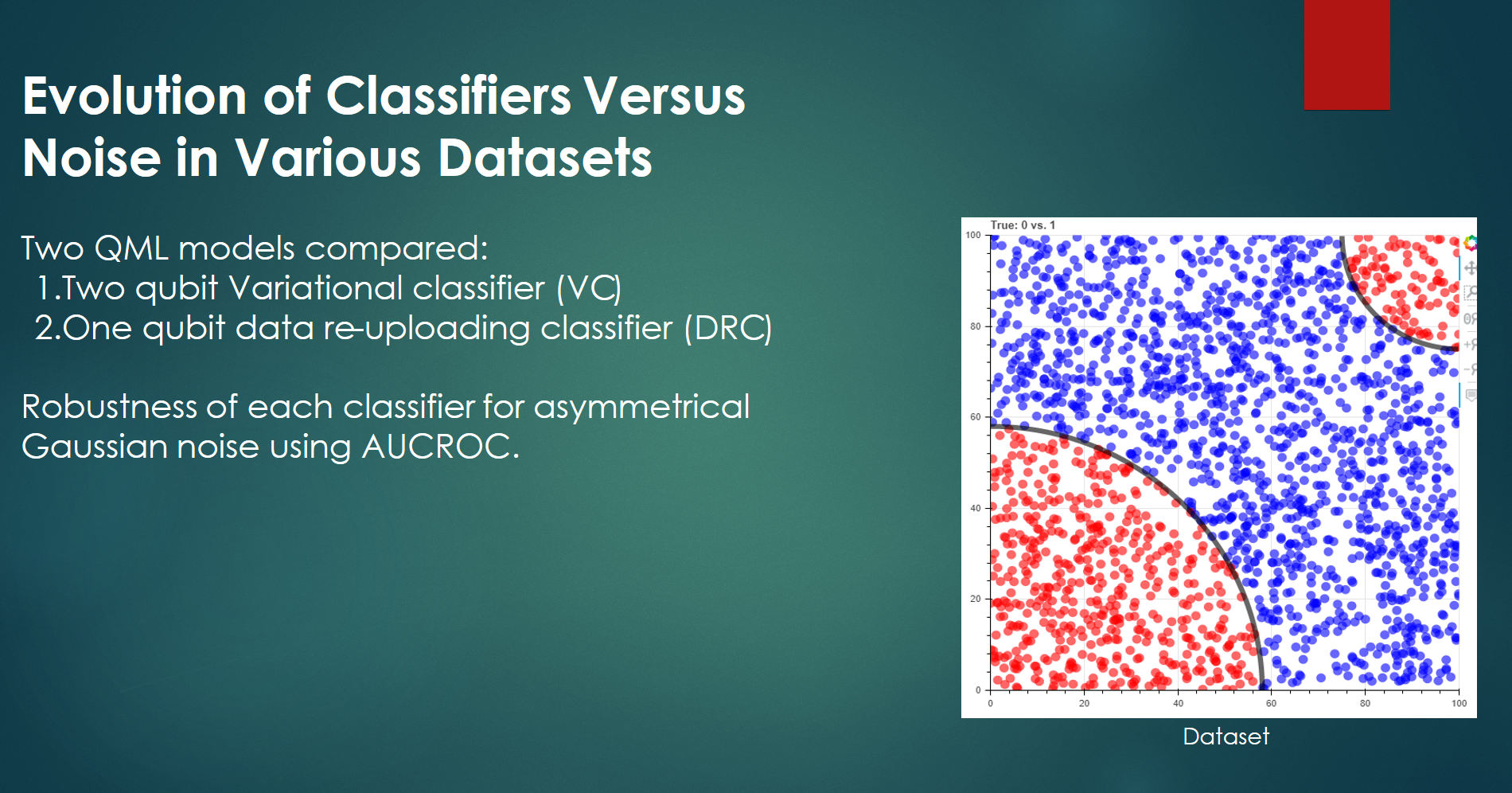

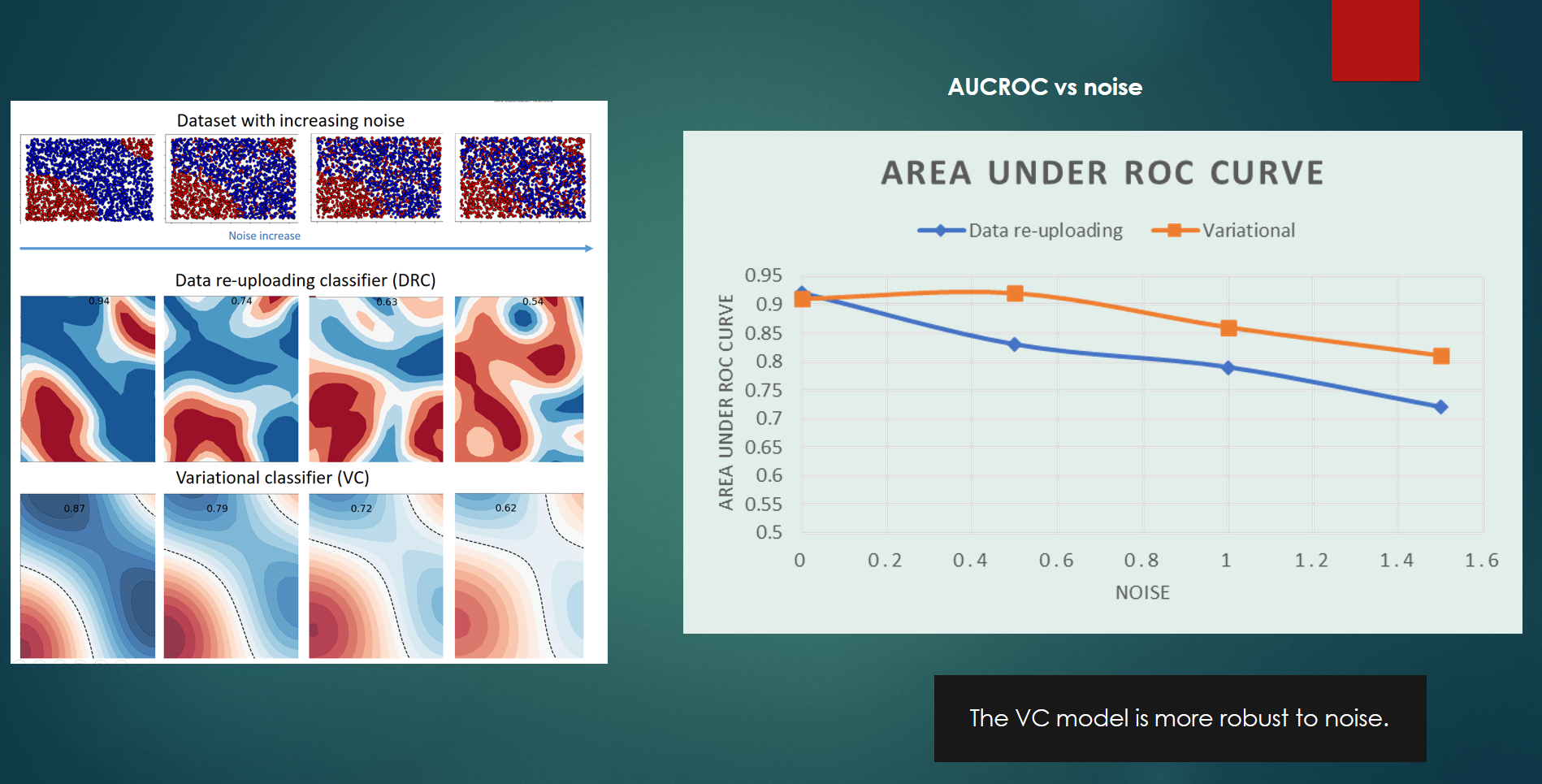

We show how Quantum Machine Learning (QML) models, similar to classical models but use quantum computers, can be used for analysing credit data for Singapore companies and also explore the effect of noise on QML models given that credit data is particularly noisy. We have obtained two main preliminary results: A boost to learning metrics (such as ROC and f1) from quantum entanglement. An improved learning power for QML models as noise is increased in the dataset. The QML models can be extended for many datasets that are currently used in any industry and we would be interested to hear from anyone with unusual or noisy datasets or facing limitations with their classical machine learning.

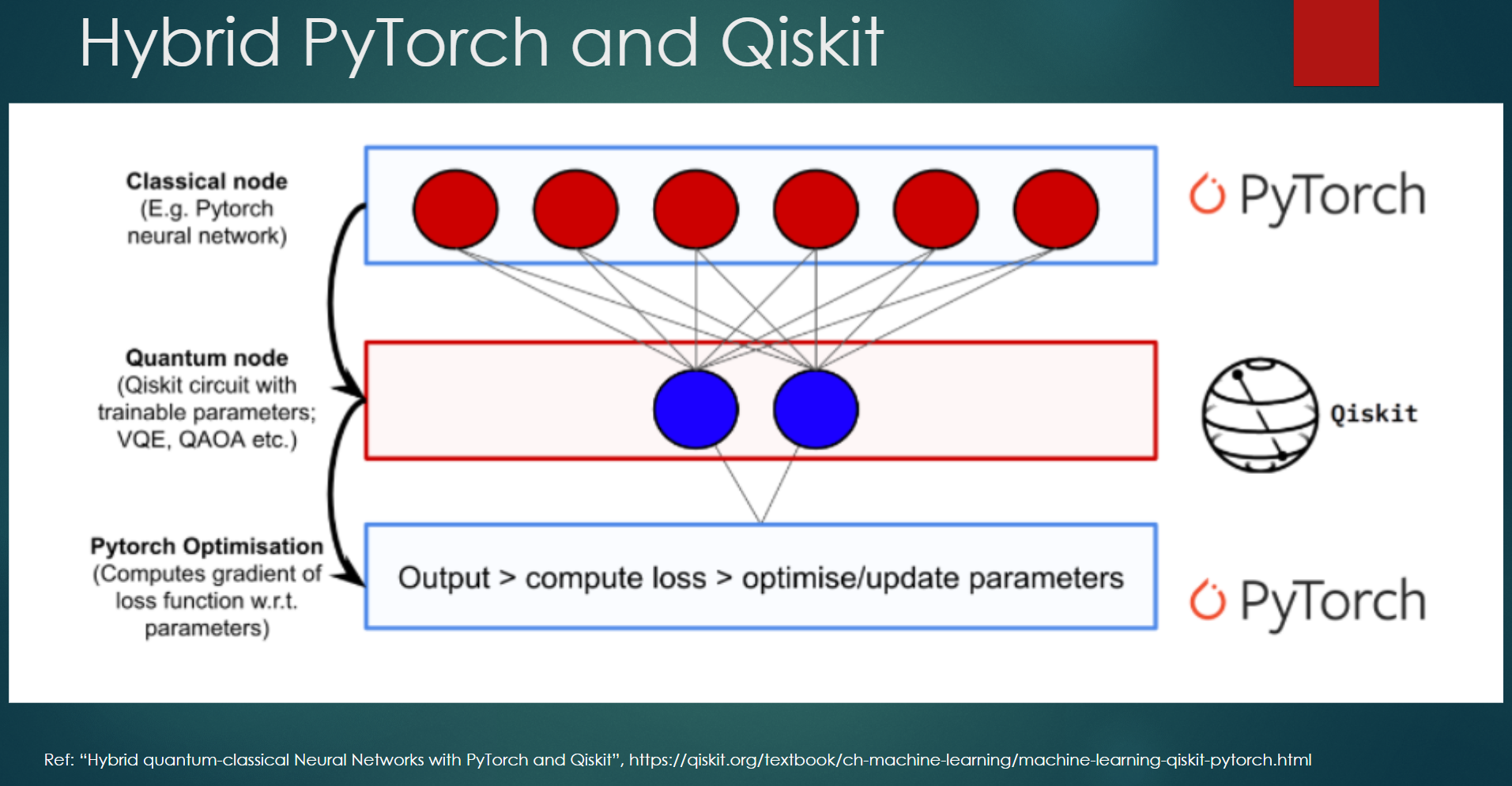

We apply Quantum Machine Learning (QML) to improve predictive models exploiting ”quantum advantage” for the common problem of the binary classification. The project is multidisciplinary in nature, strategically located at the junction of data science, classical machine learning, QML and quantum computing. QML is similar to classical machine learning but with the main difference that instead of classical neurons in layers, now we have qubits and quantum gates acting on qubits. Since we are dealing with a quantum system, one can harness the phenomena of quantum superposition and entanglement and use classical-quantum hybrid neural networks to achieve a boost in learning, i.e. a quantum advantage.The study uses credit scoring data for Singaporean companies where even a small improvement in a credit scoring model efficiency can translate to significantly lower rejections for good SMEs and a lower risk for those funding the loans. The metric used in assessing the advantage is the area under the receiver-operator curve (AUCROC).The innovative aspects of this technology centers around the use of quantum computers in machine learning algorithms. We are seeing the effects of quantum entanglement to improve learning metrics and reslience to noise in the data. Furthermore, as quantum hardware matures the size of data that can be processed increaes exponentially.

The focus of this work is on the credit rating for SMEs in Singapore but it can also be used in any industry that is currently using classical machine learning models. A range of specific QML models can be developed for any datasets that are best served by QML. The global market for machine learning is projected to grow at a Compound Annual Growth Rate (CAGR) of 42.8% until 2024, it will worth $30.6B in four years. For financial services settings, QML offers enhanced power, flexibility and representational authenticity to achieve smart, nearly real-time solutions for complex optimization, stochastic modeling, and intelligent choice problems. Any indusrry that uses optimization, neural networks, Monte Carlo simulation, machine learning and AI approaches that leverage patterns that are hard for human analysts to identify.

The main opportunity QML offers is the potential to process large datasets in a shorter time than current classical machine learning. Improved reslience to noise in datasets Non-convex datasets that do not have a global minima. For credit markets this will give more SMEs better access to funding and lower risks for lenders, improving financial inclusion. The current state of quantum computing is still in its infancy and access is limited to real quantum computers being large and expensive to build and maintain. In the future it is expected that these costs will come down over the next few years. There may also be an environmental advatage as quantum computers are anticipated to use less resources than classical computers.